what is a secondary property tax levy

What is a secondary property tax levy Monday August 29 2022 Edit. The property tax typically produces the required revenue for municipalities tax levies.

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

In other words the levy is the cap on the amount of.

. The maximum level at which local authorities can set council tax premiums on second homes and long-term empty properties will be increased to 300 which will be. Secondary Property Tax Levy debt repayment. What is a secondary tax levy.

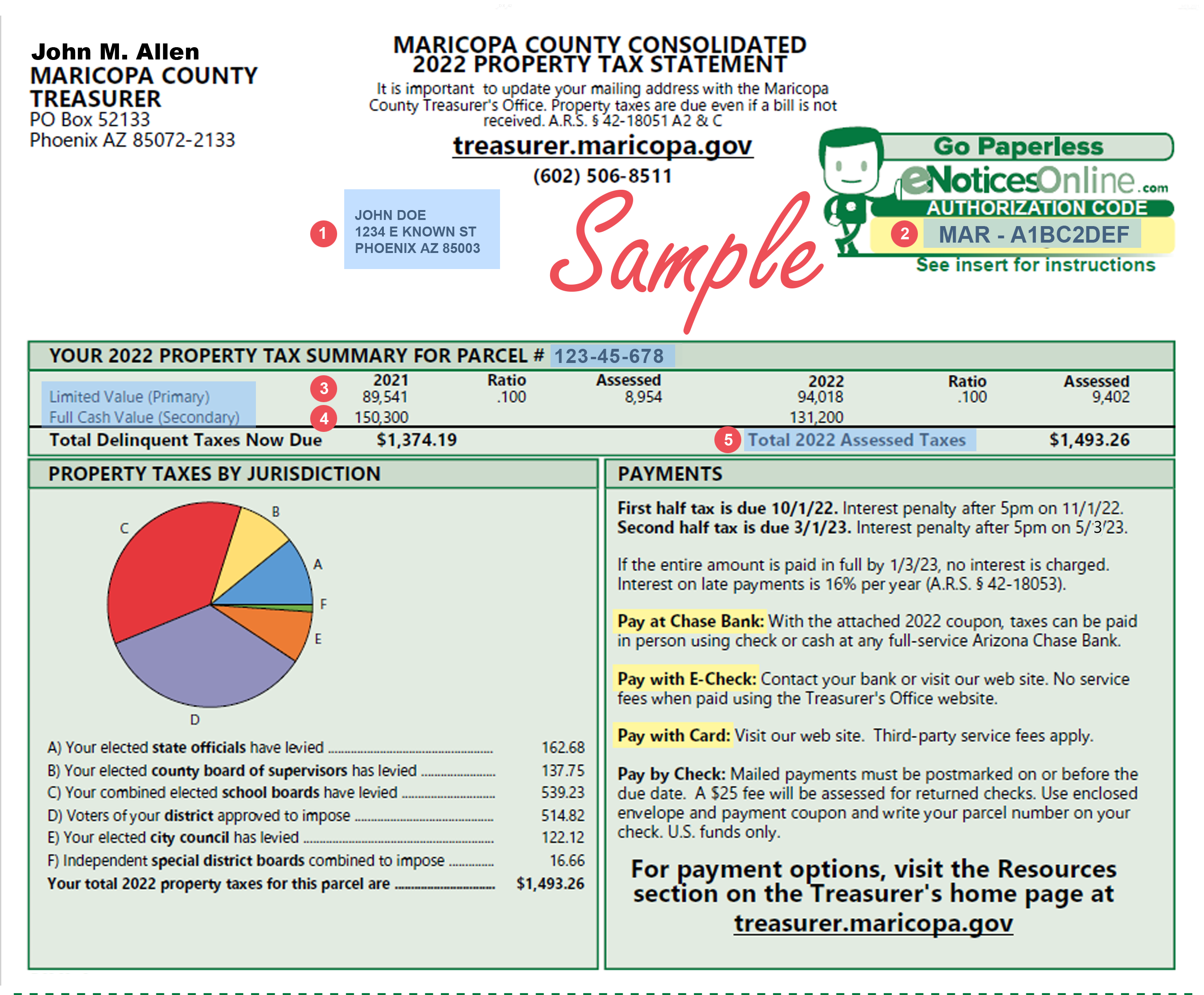

Property taxes are based on the ASSESSED VALUATION. November 13 2022 0834 AM. Jefferson City MO 65101 Map.

The City of Mesa does not collect a primary property tax. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the. Owners of second homes who abuse a tax loophole by claiming their often-empty properties are holiday lets will be forced to pay under tough new measures.

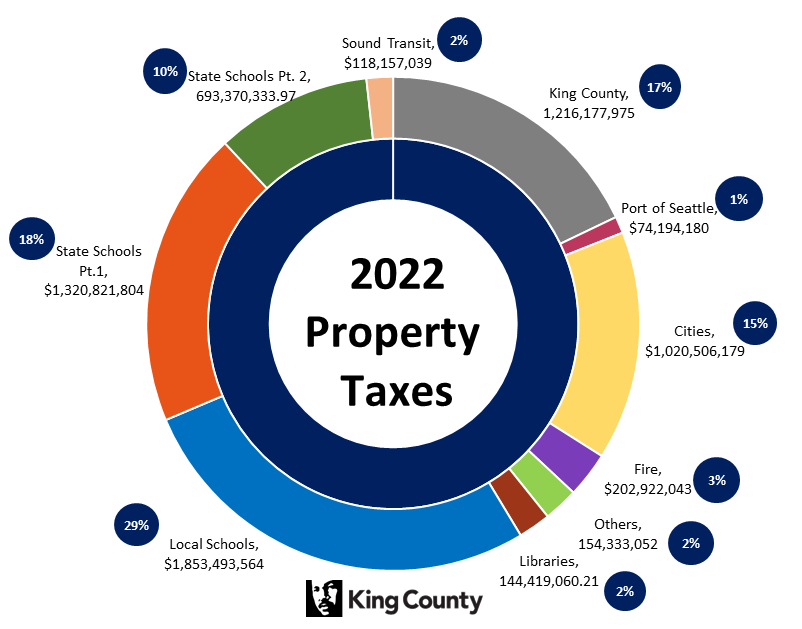

How much you pay will. T he Center Square Port of Seattle has released its proposed 2023 budget and along with it a 827 million dollar property tax levy. Reduce provincial property tax rate for other residential properties by.

2 Property Tax In. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with. Renters who lease their primary residence are not.

To help inform the discussion here are some answers to frequently asked questions. 3 on the first 250000 of the 700000 7500. Multiply this number times the assessed.

You can be charged an extra amount of Council Tax a premium if your home has been empty for 2 years or more. 8 on the final 450000 of the 700000 the amount from 250001 - 925000 36000. Land and Buildings Transaction Tax LBTT is a tax applied to purchases of land or property both residential and non-residential and to non-residential leases in Scotland.

A disadvantage to the taxpayer is that the tax liability is fixed while the taxpayers income is. Reduce provincial property tax rate for non-owner-occupied residential properties by 50 from 11233 to 05617. Secondary property taxes are levied to pay principal and interest on bonded indebtedness.

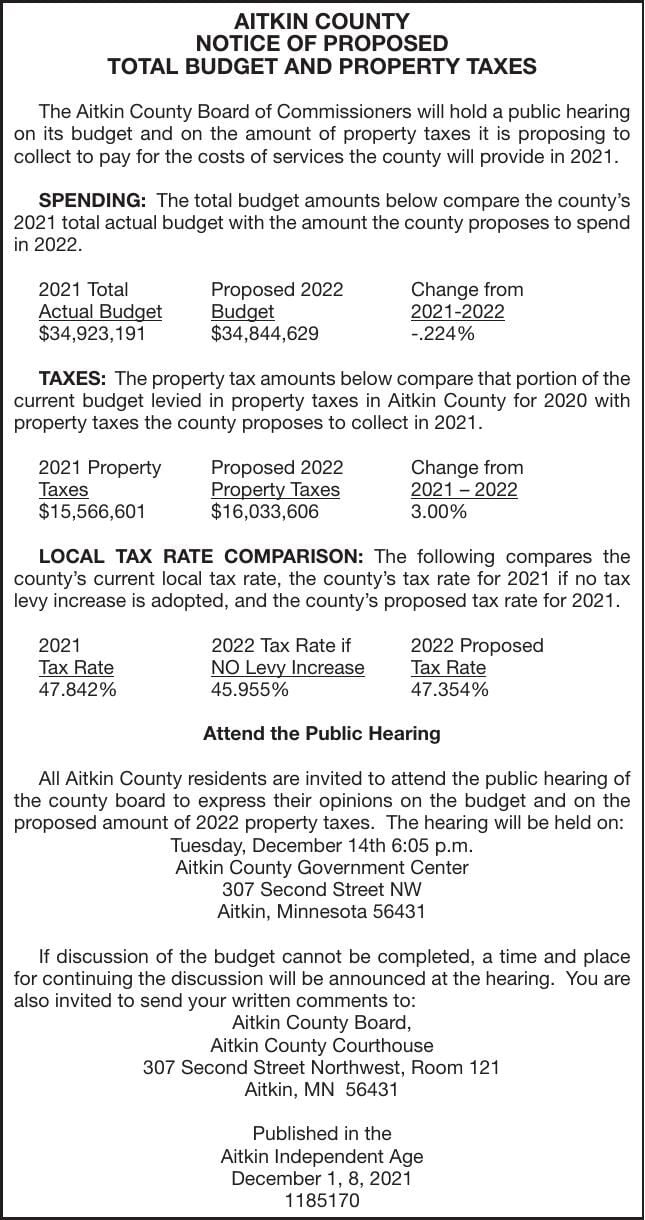

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on.

Total SDLT 43500. Property tax levies are imposed only on residents who live in the municipality and own real property whether it is mortgaged or not. Secondary property taxes 3891031 3891031 1 Current years levy 4478000 2 Prior.

If your home has been empty for 2 years or more. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Multiply the levy millage by 001.

Contact Us Main Line. Eg if the levy is 42 mills the result is 0042. Box 480 Jefferson City MO 65102-0480.

Mrsc Property Tax In Washington State

Understanding California S Property Taxes

Understanding Your Property Tax Statement Cass County Nd

Property Tax Calculator Estimator For Real Estate And Homes

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Public Hearings On Property Tax Levy And Resulting Property Tax Rate News Town Of Gilbert Arizona

Property Taxes Have Gone Up In Some Northside Neighborhoods More Than Others North News

Levies Rates And Values An Faq On Gilbert S Secondary Property Tax Community Impact

Budget Property Taxes Public Notices Messagemedia Co

Secured Property Taxes Treasurer Tax Collector

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Gilbert Budget Given Final Approval After Rejection Of Move To Maintain Levy Community Impact

About The Local Tax Finance Dashboard Gateway

The Property Tax Annual Cycle In Washington State Myticor

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute